Innovating Risk

Building Resilience

Explore groundbreaking insights and solutions that are redefining the reinsurance landscape

Explore groundbreaking insights and solutions that are redefining the reinsurance landscape

Dive into over 35 sessions led by top industry experts, covering critical topics like cyber risk, parametric insurance, and advanced reserving methodologies. Strengthen your expertise, connect with fellow professionals, and gain actionable insights tailored to the evolving reinsurance landscape. Explore the full schedule of sessions and speakers when our final program listing becomes available.

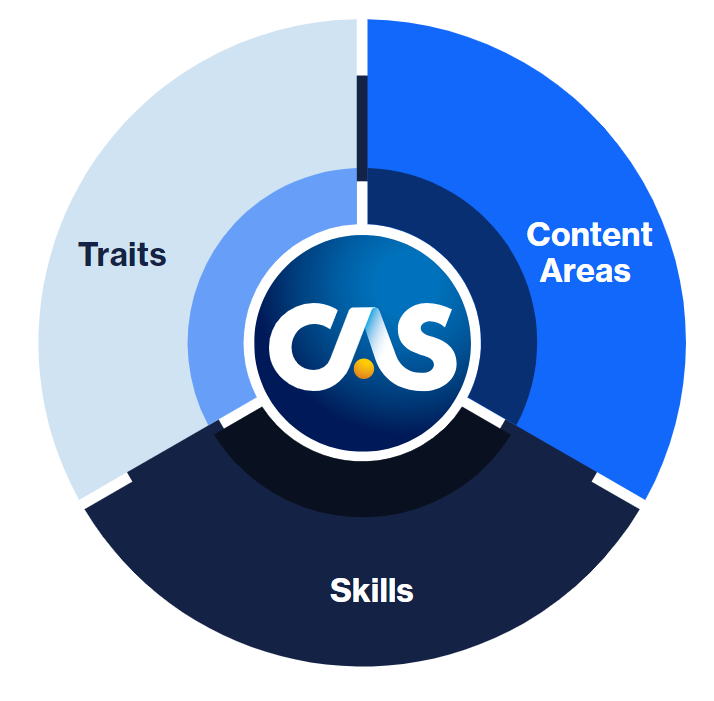

The CAS Capability Model is a visual framework that articulates and provides guidance on the traits, skills and knowledge important for most property/casualty actuaries.

Volunteer Chair

Volunteer Vice Chair

Staff Chair

Staff Chair

Stay ahead in the evolving reinsurance landscape. Earn up to 13.8 CE credits through dynamic sessions on AI-driven advancements, cyber risk management, and parametric insurance solutions. Refine your expertise and gain actionable tools from top industry experts.

Build valuable connections with fellow actuaries and industry experts. Take advantage of ample networking opportunities to expand your professional network and engage with exhibitors showcasing cutting-edge solutions and expertise in Ratemaking, Product Innovation, and Modeling.

Explore advanced topics tailored to reinsurance professionals. Sessions on abnormal data sets, reinsurance pricing strategies, and alternative reserving methods provide focused expertise to tackle today’s complex industry challenges with confidence.